Low Carbon Economy Index

Table: Key announced but unenacted tax and superannuation measures

| Measure | Status |

|---|---|

| Business tax | |

| FBT relief for COVID-19 test expenses | Announced in March 2022 to apply from the beginning of the 2021‑22 tax year. |

| Preventing franked distributions funded by capital raisings | Originally announced in the 2016-17 Mid Year Economic and Fiscal Outlook (MYEFO) and proposed to apply to distributions made after 12:00pm (AEDT) on 19 December 2016. |

| Reforming the integrity provisions in the debt/equity rules | Draft legislation to implement the Board of Taxation’s recommended approach to improve the debt/equity tax rules was released in October 2016. The new rules are proposed to apply prospectively from a day to be fixed by proclamation (or if there is no proclamation, six months after Royal Assent of the enabling legislation). |

| Removing barriers to the use of asset backed financing | Originally announced in the 2016-17 Federal Budget and proposed to apply with effect from 1 July 2018. |

| Reform of taxation of financial arrangements (TOFA), including taxation of foreign exchange | Originally announced in the 2016-17 Federal Budget. The start date has been deferred until income years that begin after Royal Assent of the enabling legislation. More changes were announced in the 2021-22 Federal Budget to simplify hedging rules in TOFA. These changes are proposed to apply from 1 July 2022. |

| Reduce FBT record keeping requirements (providing the Commissioner of Taxation with powers to accept existing corporate records instead of requiring employee declarations) | Announced in the 2020-21 Federal Budget. The measure will have effect from the start of the first FBT year (1 April) after the date of Royal Assent of the enabling legislation. |

| Division 7A (private company deemed dividends) reforms | Originally announced in the 2016-17 Federal Budget. The start date has been deferred to income years commencing on or after the date of Royal Assent of the enabling legislation. |

| Patent Box Regime | Announced in the 2021-22 Federal Budget. The measure commences from 1 July 2022 for patents granted or issued after 11 May 2021. This measure is currently in a Bill before Parliament. Further extensions were announced in the 2022-23 Federal Budget. |

| Self-assessment of effective lives of intangible assets | Announced in the 2021-22 Federal Budget to apply from 1 July 2023. This measure is currently in a Bill before Parliament. |

| Digital Games Tax Offset (DGTO) | Exposure draft legislation released for comment on 21 March 2022 to give effect to this 2021-22 Federal Budget proposal as extended by the 2021-22 MYEFO. Proposed to commence from 1 July 2022. |

| Sharing economy reporting regime | Proposed to apply from 1 July 2022 for ride-sharing and accommodation platforms and from 1 July 2023 for asset sharing, food delivery, tasking-based platforms. This measure is currently in a Bill before Parliament. |

| Corporate tax residency | Originally announced in the 2020-21 Federal Budget and proposed to apply from the first income year following Royal Assent of the enabling legislation with an option for taxpayers to apply the law from 15 March 2017. It was also announced in the 2021-22 Budget that there would be consultation on expanding the corporate tax residency rules to trusts and corporate limited partnerships. |

| Petroleum Resource Rent Tax compliance and administration changes | Originally announced in November 2018 to apply to income years commencing on or after three months after the date of Royal Assent of the enabling legislation. |

| Asset and wealth management | |

| Removal of the capital gains tax (CGT) discount at trust level for Managed Investment Trusts (MITs) and Attribution MITs | Announced in the 2018-19 Federal Budget. The start date has been deferred to income years commencing on or after three months after the date of Royal Assent of the enabling legislation. |

| Personal tax and superannuation | |

| Modernising individual tax residency rules | Announced in the 2021-22 Federal Budget to apply from income years commencing after the date of Royal Assent of the enabling legislation. |

| Taxation of income for use of an individual’s fame and image | Originally announced in the 2018-19 Federal Budget to apply from 1 July 2019. |

| Tax deductions for COVID-19 test expenses for workers | Announced in March 2022 to apply from the beginning of the 2021‑22 tax year. |

| International | |

| Expanded tax treaty network | Announced in September 2021 that Australia expected to enter into ten new and updated tax treaties by 2023. |

For those measures that are currently before Parliament, any Bills that have not passed before the calling of the Federal election will lapse when Parliament is prorogued. This means the next Government will have to re-introduce the measure following the election if the measure is to be progressed.

The Board of Taxation also has a number of Government initiated reviews currently underway or completed in recent months which may also result in future amendments and reform of the Australian tax landscape. These include reviews of:

- the Low Value Imported Goods measures that facilitate the collection of Goods and Services Tax on low value imported goods (report released with the 2022-23 Federal Budget)

- the dual-agency administration model (by Industry, Innovation and Science Australia and the Australian Taxation Office) of the research and development tax incentive (report released with the 2022-23 Federal Budget)

- capital gains tax rollover rules (final report to be completed by 22 April 2022), and

- the taxation of digital assets and transactions (review to be completed by 31 December 2022).

With respect to the reports released with the 2022-23 Federal Budget, the Government noted the Board’s valuable insights and has stated that it will continue to consider the implications of the reports.

We will also hear from the Opposition Leader in the Budget reply speech scheduled for Thursday 31 March 2022, which may highlight some of the Australian Labor Party’s tax policies that they intend to take into the Federal election.

There is clearly no shortage of work to be done on the tax front. Whilst large-scale long-term tax reform might continue to be on the backburner, it must feature in future budgets to ensure a return to a position of sustained economic growth, and address the over-reliance on personal and corporate taxes, intergenerational inequities, and reliance on unsustainable tax bases to support government expenditure. We discuss this, and more, in our series Australia Rebooted: Where next for Australia’s tax system.

Conscious uncoupling?

Low Carbon Economy Index – October 2015

In December, Governments meet in Paris to agree how to tackle climate change. The deal is expected to have far reaching implications, affecting energy, transport, industry, buildings and finance. It will change investment decisions made by companies and spending decisions made by consumers.

October 2015

Australia will need to nearly double its historic rate of decarbonisation, to 4.4% annually, if it is to meet its goal of 26% decrease in carbon emissions on 2005 levels by 2030.

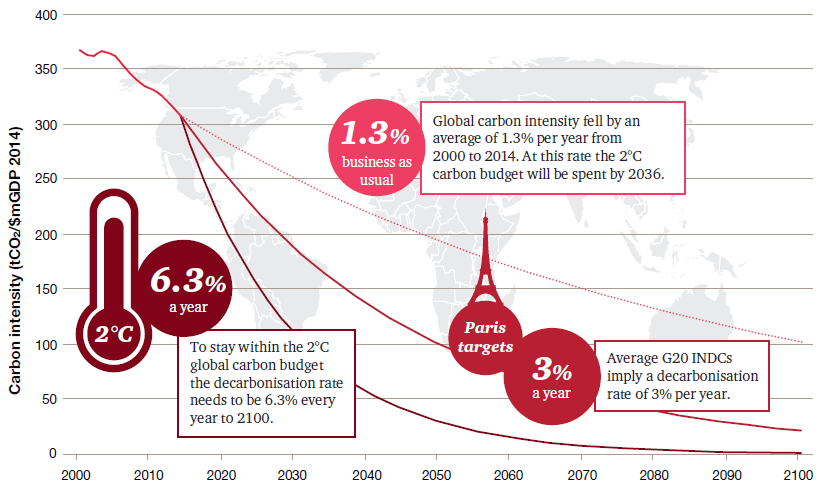

Our 7th annual Low Carbon Economy Index (LCEI) tracks the rate that G20 countries are decarbonising their economies by measuring decreases in their ‘carbon intensity,' or the ratio of carbon emissions relative to GDP growth. Breaking the link between growth and emissions is seen as essential in avoiding the worst impacts of climate change.

Australia is making progress on carbon, but there is more work to do

- Since 2000, Australia's carbon intensity has fallen on average 2.4% annually, but this is still well below the 4.4% required to reach the target Australia will take to the UN Climate Change conference in Paris this December.

- Australia's average decarbonisation rate actually puts it in in the top five best performers in the G20. In 2013 and 2014 the decarbonisation rate was 4.5% and 4.7% respectively, so maintaining that rate could mean hitting the Government's 26% target.

- Across the G20, an average annual reduction of 6.3% out to 2030 is needed to meet the target. Based on how Australia has tracked historically, it could be argued that there is scope to be more ambitious.

What does it mean for business?

Three consistent themes have emerged from the Intended Nationally Determined Contributions (INDCs), that is, the publicly declared country commitments that will be taken to Paris:

- A rapid investment in renewables and their share of the energy mix.

- The engagement of the financial services sector in delivering this investment, as well as assessing the sector's exposure to instability as a result of climate change.

- A focus on coal-fired power generation in countries' decarbonisation pathways.

Australia's energy mix will need to continue to evolve.

Australia's energy mix will need to continue to evolve to keep Australia on track to meet its 2030 emissions target. Energy producers that rely on coal, gas, and oil will be very much part of the solution. The key for these businesses will be taking a portfolio view, and looking for opportunities to diversify into wind, hydro, solar, and emerging technologies.