What is ESG exactly?

ESG encompasses three main areas, as seen under each pillar below. In short,

- Environmental: involves factors like climate change, greenhouse gas emissions, natural resources and regenerative agriculture, water stress and conservation, biodiversity, pollution, and waste.

- Social: animal welfare, nutrition and health, sustainable sourcing, your reputation in local communities, employee engagement and well-being.

- Governance: refers to the systems and processes used to make decisions, manage operations, and interact with stakeholders. It focuses on responsible, ethical conduct, transparency and maintaining trust - with employees, customers, investors and the community.

Climate change — and measuring emissions — is the cornerstone of the environmental pillar and essential to any ESG efforts. It's one of the most immediate factors needing action and the one we get asked about most. It's worth explaining in some depth.

The Greenhouse Gas Protocol ('GHG Protocol') is the main global standard for carbon accounting. The GHG Protocol Agricultural Guidance focuses on how this is to be interpreted by the agricultural sector. It breaks down emissions into three Scopes:

Scope 1: direct GHG emissions from sources owned or controlled by you or your farming operation, including methane from cattle, nitrous oxide from fertiliser, and emissions from mechanical equipment and company vehicles.

Scope 2: indirect emissions from the generation of purchased energy, like electricity used on your farm.

Scope 3: indirect emissions in your supply chain, such as emissions associated with procurement, transport, product use, and end-of-life disposal. These usually make up the most significant portion of the carbon footprint.

It’s important to note that Scope 1 and 2 emissions will often form a substantial part of the Scope 3 inventories for downstream processors and retailers of agricultural products, as well as upstream suppliers of farm inputs such as seed and fertiliser. The significance of this is that failure to reduce 1 and 2 emissions can negatively impact your supply chain, market access and product value.

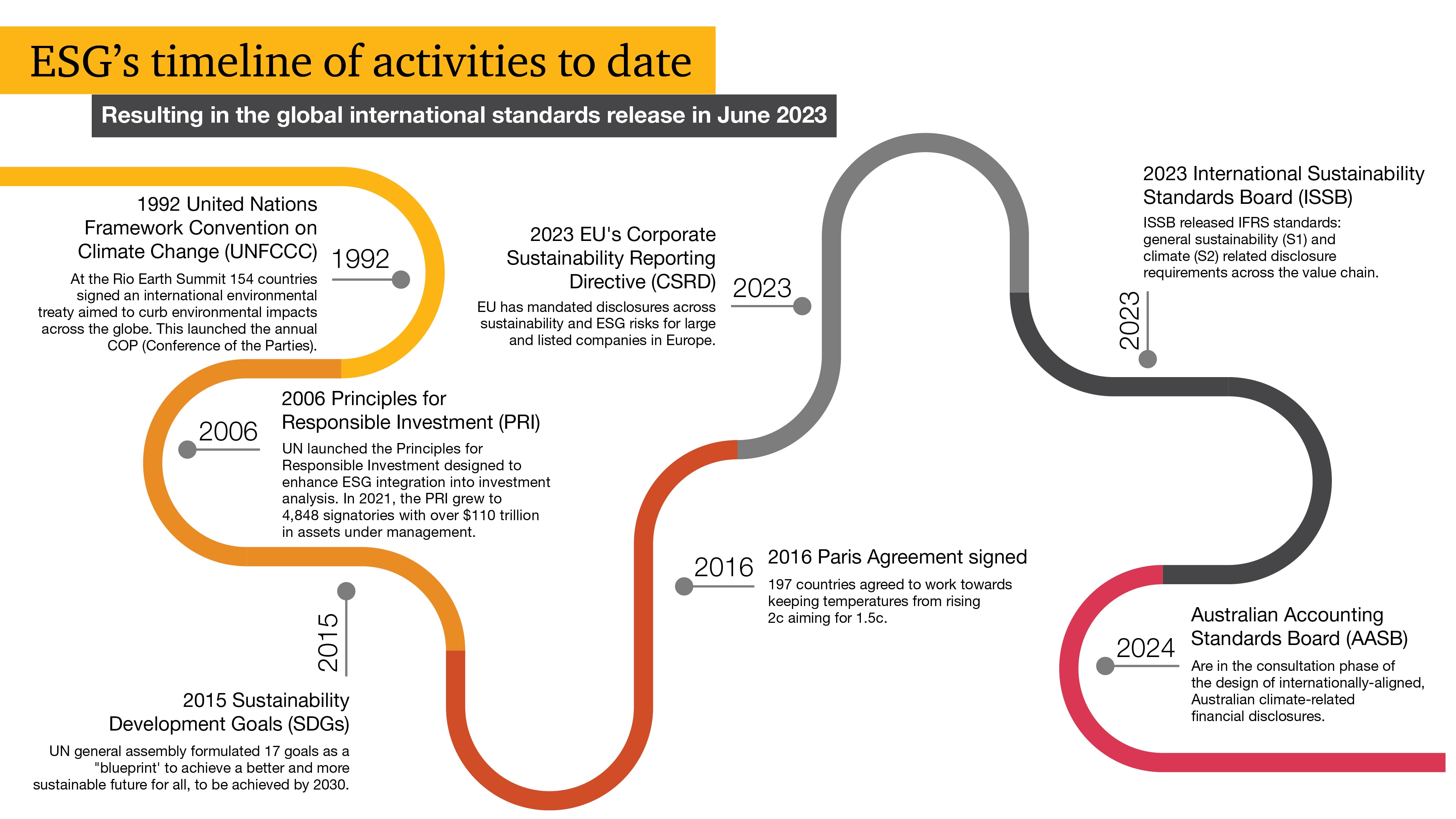

Why is it important now?

The Australian Government has legislated an emissions reduction target of 43% below 2005 levels by 2030, and committed to Australia reaching net-zero emissions by 2050. This is not far away. These targets introduce new requirements across the agricultural supply chain from farm gate to plate.

Additionally, Australia is in the process of adopting mandatory climate reporting standards, based on the recently released International Sustainability Reporting Standard IFRS S2. These are expected to apply from as early as July 2024 to large companies, and extend to all financial reporting entities over the following three years.

For those keeping an eye on this evolving landscape, there is potential to maximise new opportunities while mitigating any exposure to:

What can I do?

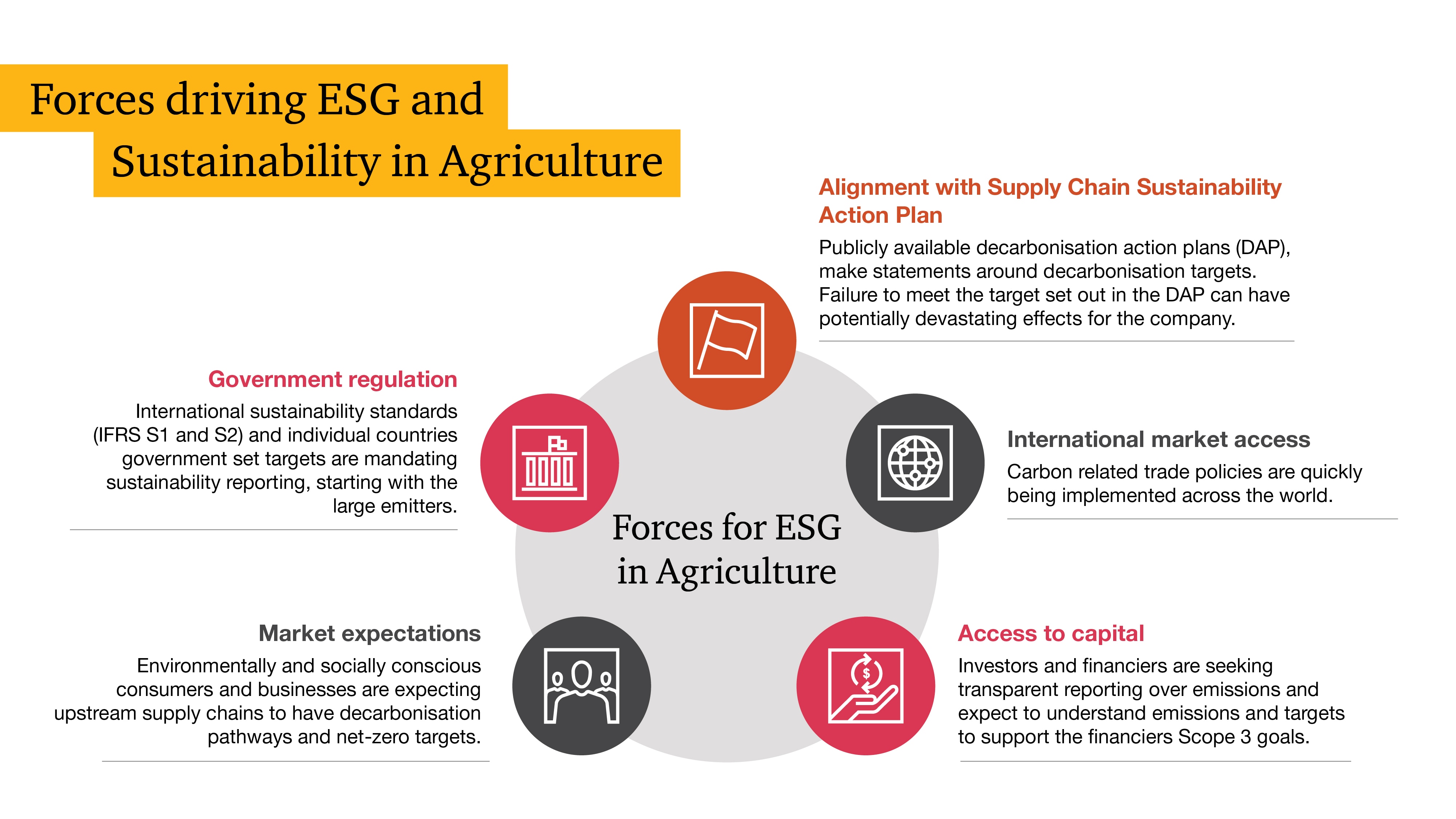

The key message here is that ESG represents changing expectations for agribusinesses like yours around how you produce, sell your product, and even how you communicate. Transparent communication about your ESG initiatives is essential. You need to document and openly discuss your sustainable practices and commitment to ESG principles to satisfy market expectations. This is especially important given the growing number of consumers willing to pay extra for environmentally and socially responsible choices.

The increasing importance of ESG is creating new value-creation opportunities for Australian agribusinesses who understand what it is, what ESG factors are most relevant to them, how best to implement effective methodologies, and how best to measure and communicate their progress. We delve into this in more detail throughout our series.

Conversely, for those slower to adapt, ESG presents a challenge, as non-compliance can jeopardise market access and erode value.

Where are you on this journey? Are you turning ESG challenges into opportunities for growth?

If you would like to talk to a PwC advisor about your ESG strategy, get in touch. We can help with a decarbonisation strategy, emissions accounting, and ESG reporting and governance frameworks.