{{item.title}}

{{item.text}}

{{item.title}}

{{item.text}}

The pressure on Finance to do more with less has never been greater. Finance needs to lead from the front to drive change and operate as strategic business partners. This requires Finance to act with agility, deliver actionable data driven insights and rapidly evaluate multiple scenarios. It is reinforcing the need for Finance to transform and adapt to the new world where new skills, behaviours and ways of working are required to be a leading Finance function.

Now is the time to embrace technology and digital innovation, invest in the skills of your team and define new ways of working. This is modern finance.

Move from transactional processing to strategic, actionable insights. PwC’s expertise, services and solutions help you accelerate your finance transformation, no matter where you are on your journey.

Use a combination of modern and traditional levers to help accelerate growth, improve cost structure, and reinvigorate the workforce.

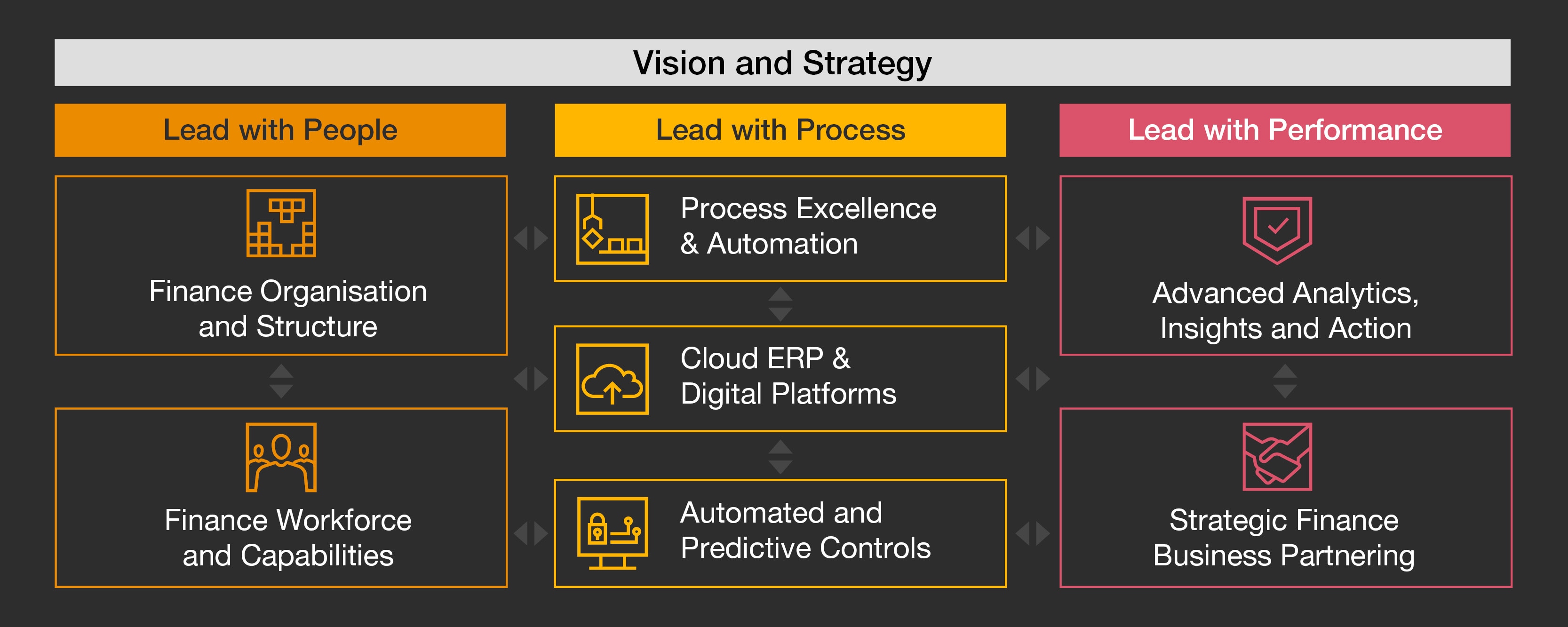

Finance modernisation is a strategic shift in the Finance operating model enabled by continuous digital transformation across People, Process, and Performance.

Although it is anchored around seven levers - you can start anywhere but only true value is achieved when these are orchestrated together successfully through transformation.

PwC’s suite of Finance Transformation solutions helps you navigate today’s challenges, so you can move forward with confidence into tomorrow.

Explore our suite of services and solutions to modernise your Finance function.

Establish a blueprint to your modern Finance strategy that will improve operational effectiveness and capabilities.

Establish a blueprint to your modern Finance vision and strategy that will transform your people, processes and technology aimed at helping to reduce costs, and improve operational effectiveness and capabilities.

Services & Solutions:

Explore the “art of the possible” of a modern Finance function, through interactive and hands-on workshops designed to help your team rapidly innovate and transform.

Benchmark against your peers on effectiveness, maturity and costs of your Finance function.

Develop the optimal target operating model to support your strategic objectives.

Implement strategies to reduce operational complexity, streamline processes, and optimise the use of technology for your core finance processes.

Implement strategies to reduce operational complexity, streamline processes, and optimise the use of technology for your core finance processes: Procure-to-Pay, Order-to-Cash, Record-to-Report, and Acquire-to-Retire. This leads to improved efficiency, control and quality, lower cost, and increased capacity for business partnering and collaboration.

Services & Solutions:

Assess and implement leading technologies to automate and transform your core finance processes, leveraging cloud technology.

Establish global process ownership to drive efficiency and innovation, and embed citizen-led continuous improvement.

Improve your working capital and liquidity by enhancing transactional efficiencies.

Implement the optimal service delivery model and organisational design to support the strategic objectives of your business.

Implement the optimal service delivery model and organisational design to support the strategic objectives of your business, while driving sustainable cost savings, standardisation, quality, enhanced skills and capabilities, and agility.

Services & Solutions:

Develop and implement a future global service delivery model, including shared service centres, outsourcing, centres of excellence, and agile finance teams.

Establish the optimal organisational design to support the needs of the business, including role identification (traditional and emerging) and responsibilities, spans and layers, and interaction models to support the needs of your business.

Improve functional and digital acumen and build a culture of innovation and advancement through tailored learning and development programs.

Attract and retain the next generation of employees and leverage the gig economy.

Evolve your analytics capabilities from descriptive to predictive insights by aligning objectives with enterprise strategy.

Evolve your analytics capabilities from descriptive to predictive insights by aligning objectives with enterprise strategy, enabling a data-driven culture, and implementing the right technology and enabling infrastructure.

Services & Solutions that improve

Improve the effectiveness of your planning, budgeting, forecasting, consolidation, and management and statutory reporting processes to enable better analytics, insights and action.

Assess and implement leading technologies to automate and transform your core reporting processes, leveraging cloud technology and the use of predictive capabilities.

Accurately determine the product cost of a unit of production or service to drive objective, data-driven discussions of your business performance.

Enhance utilisation of data and embed analytics and AI models into your operations to deliver greater value to your business partners.

Leveraging technology to accelerate impact.

PwC & Microsoft help clients to future proof their finance functions by modernising business processes, increasing visibility through analytics and machine learning while securely unlocking the value of the Microsoft cloud.

Streamline processes and redefine efficiency.

PwC has embedded best practices on SAP S4/HANA, SAP Integrated Business Planning and Mii modules.

A formula for growth in a changing world.

PwC and Oracle help clients achieve and maintain financial and operational stability and agility by planning successful journeys through financial and operational challenges.

Peter Kurtz

Partner, Advisory, Finance Transformation, PwC Australia

Tel: +61 451 778 511