What are the Australian Sustainability Reporting Standards?

The International Sustainability Standards Board (ISSB) issued its inaugural sustainability disclosure standards (IFRS S1 & IFRS S2) on 26 June 2023. The Standards form a comprehensive global baseline of sustainability disclosures designed to meet the information needs of capital market stakeholders.

- IFRS S1 ‘General Requirements for Disclosure of Sustainability-related Financial Information’ provides guidance on identifying sustainability-related risks and opportunities, and the relevant disclosures to be made in respect of those sustainability related risks and opportunities.

- IFRS S2 ‘Climate-related Disclosures’ is a thematic standard that sets out the requirements for identifying, measuring and disclosing climate-related risks and opportunities.

The Australian Accounting Standards Board (AASB) issued the final ASRSs on 20 September 2024 following a consultation period relating to the draft ASRSs (Exposure Draft ED SR1) that ended in March 2024. The AASB has taken a ‘climate first’ approach to adopting IFRS S1 and IFRS S2 to align with Government commitments to introduce mandatory climate reporting in Australia. Therefore, the final standards issued by the AASB are:

- AASB S1 - General Requirements for Disclosure of Sustainability-related Financial Information which is a voluntary Standard covering sustainability-related financial disclosures and aligns with the scope of IFRS S1.

- AASB S2 - Climate-related Disclosures which is a mandatory Standard that incorporates the necessary content presented in IFRS S1 allowing it to function as a standalone, climate-only Standard.

What has changed since the Exposure Draft?

Based on feedback from the consultation period the AASB has sought to re-align the ASRSs with the ISSB’s IFRS S1 and IFRS S2 baseline.

The key changes from the proposals in the exposure draft to the final ASRSs have been outlined below:

| Key changes from exposure draft proposals |

Key changes as a result include:

|

| Key differences to IFRS Sustainability Disclosure Standards that remain |

Whilst the AASB have sought to align AASB S2 with IFRS Sustainability Disclosure Standards as much as possible, some of the key differences that remain are:

|

Core mandatory content of Australian Sustainability Reporting Standards

The core content of the final ASRSs largely aligns with the content of the IFRS Sustainability Disclosure Standards, and with the four pillars approach originally included in the Task Force on Climate Related Financial Disclosures (TCFD) recommendations. The core disclosures required by ASRSs are:

Who is required to report and when does it apply?

The scope of who is required to prepare a sustainability report, and when they must begin this reporting, is set out in the legislation passed by Parliament on 9 September 2024.

Entities that report under Chapter 2M of the Corporations Act, (including listed and unlisted companies and financial institutions, registrable superannuation entities and registered investment schemes) that meet any one of the following for a financial year are required to prepare a sustainability report in line with the timeline set out in the table below:

- Two of the three stipulated size criteria (consolidated revenue, consolidated gross assets and consolidated number of full-time equivalent employees); or

- is a registered corporation under the NGER Act (or required to make an application to register); or

- is an asset owner (defined as registerable superannuation entities, registered schemes and retail Corporate Collective Investment Vehicles (CCIVs)) where the value of assets at the end of the financial year (including the entities it controls) is equal to or greater than $5bn.

Exemptions would be available for:

- Small businesses below the relevant size thresholds.

- Entities exempted from lodging financial reports under Chapter 2M of the Corporations Act (e.g. ACNC registered Australian Charities and Not-for-profits).

| First annual reporting periods starting on or after |

Large entities and their controlled entities meeting at least two of three criteria: | National Greenhouse and Energy Reporting (NGER) Reporters |

Asset Owners (Registerable Superannuation Entities, Registered Schemes and Retail CCIVs) | ||

| Financial year consolidated revenue |

End of financial year consolidated gross assets |

End of financial year full time equivalent employees |

|||

| 1 January 2025 Group 1 |

$500m or more | $1bn or more | 500 or more | Above NGER publication threshold (50 ktC02-e Scope 1 and 2 emissions) |

N/A - entities are explicitly excluded from Group 1 |

| 1 July 2026 Group 2 |

$200m or more | $500m or more | 250 or more | All other NGER reporters | $5bn or more assets |

| 1 July 2027 Group 3 |

$50m or more | $25m or more | 100 or more | N/A | N/A |

An asset owner is a registered scheme, a registrable superannuation entity or a retail corporate collective investment vehicle. An ‘asset owner’ cannot be a Group 1 entity, even if it would otherwise meet the criteria to be a Group 1 entity. An asset owner can be a Group 2 entity either by meeting the criteria applicable to all entities, or by having $5bn or more in assets.

All entities within Group 1 and Group 2 would be required to prepare a sustainability report for the year consistent with the relevant sustainability standards issued by the AASB. All entities within Group 3 are also subject to this requirement, unless the relevant entity does not have material climate risks and opportunities, whereby they are exempt from preparing a full sustainability report. Instead, these entities need to make a disclosure of a statement that they do not have material climate risks and opportunities, and the reasons why.

Group 1 entities must report for financial years beginning on or after 1 January 2025. Group 2 and Group 3 entities must report for financial years commencing on or after 1 July 2026 and 1 July 2027, respectively.

What form does the reporting take and where does the reporting need to be disclosed?

The legislation requires an annual ‘sustainability report’ which entities will need to prepare, consisting of:

a climate statement for the year;

notes to the climate statement;

any statements required by a legislative instrument relating to matters concerning environmental sustainability; and

a directors’ declaration.

The report must be provided to the members and lodged with ASIC.

There is no exception available in the legislation for subsidiaries of overseas groups to lodge an overseas parent’s consolidated sustainability report in lieu of a local Australian report. Therefore, if an Australian group that is a subsidiary of an overseas parent meets the criteria to prepare a report set out above, sustainability reporting will have to be prepared at the Australian level, approved by the Australian directors, and lodged with ASIC.

Directors’ obligations and liability framework

The legislation introduces a transitional limited immunity for directors related to some information within the sustainability report.

No action can be brought in relation to disclosures on Scope 3 greenhouse gas emissions, scenario analysis, and transition plans for financial years commencing during a three-year period from 1 January 2025.

No action can be brought in relation to climate disclosures made about the future, for financial years commencing during a one-year period from 1 January 2025.

The above limited immunity does not apply if the action is brought by ASIC or is criminal in nature.

As noted above, the directors will be required to make a specific directors’ declaration with respect to the sustainability report. The directors' declaration issued would be required to cover the compliance of the climate statement and notes with the relevant sustainability standards issued by the AASB.

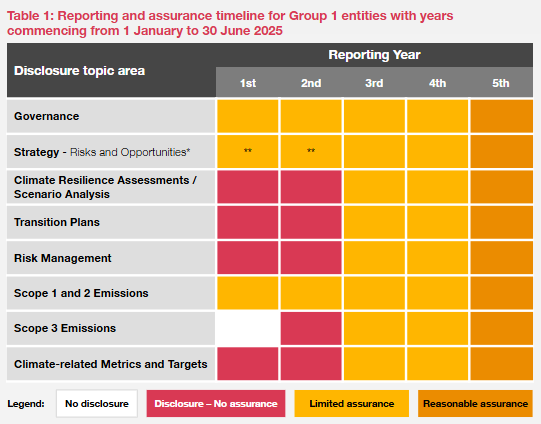

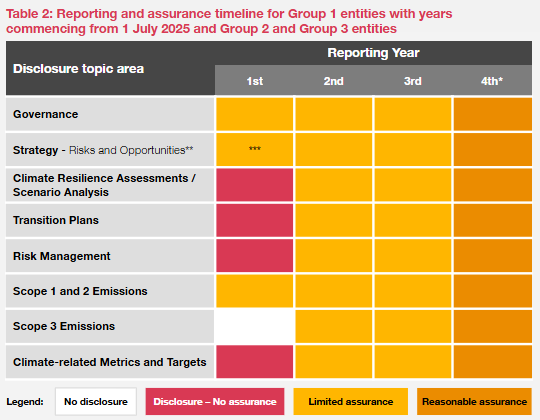

Timeline and new standard for assurance

What should you do now?

The sustainability reporting landscape is evolving rapidly

‘No regret’ moves to prepare for the changes ahead.

Download the full report

Contact us

Caroline Mara

Partner, Assurance, Sustainability Reporting and Assurance Leader, PwC Australia